what is the marginal benefit to a producer of an extra pound of apples in panel (a)?

6.2 Maximizing in the Marketplace

Learning Objectives

- Explicate what is meant by an efficient allocation of resource in an economy and describe the marketplace conditions that must exist to achieve this goal.

- Ascertain consumer and producer surplus.

- Hash out the relationship between efficiency and equity.

In perchance the most influential volume in economics ever written, An Enquiry into the Nature and Causes of the Wealth of Nations, published in 1776, Adam Smith argued that the pursuit of self-involvement in a marketplace would promote the full general interest. He said resources would be guided, equally if by an "invisible manus," to their all-time uses. That invisible hand was the marketplace.

Smith'due south idea was radical for its time; he saw that the seemingly haphazard workings of the market could promote the common good. In this section, nosotros will use the tools we have developed thus far to see the power of Smith'south invisible paw. Efforts by individuals to maximize their own net benefit can maximize internet benefit for the economic system as a whole.

When the cyberspace benefits of all economic activities are maximized, economists say the allocation of resources is efficientThe allocation of resources when the net benefits of all economic activities are maximized. . This concept of efficiency is broader than the notion of efficient production that we encountered when discussing the production possibilities curve. In that location, nosotros saw that the economic system'south factors of production would be efficient in product if they were allocated co-ordinate to the principle of comparative advantage. That meant producing as much equally possible with the factors of product available. The concept of an efficient resource allotment of resources incorporates production, as in that word, simply it includes efficiency in the consumption of goods and services every bit well.

Achieving Efficiency

Imagine yourself arriving at the store to purchase some food. In your option, you will counterbalance your own benefits and costs to maximize your net benefit. The farmers, the distributors, and the grocer have sought to maximize their net benefits equally well. How can nosotros expect that all those efforts will maximize internet benefits for the economy as a whole? How can we expect the market to achieve an efficient allocation of food, or of anything else?

1 status that must be met if the marketplace's allotment is to be efficient is that the marketplace must be competitive or role every bit if information technology were. Nosotros volition accept a dandy bargain more to say about competitive markets versus less competitive ones in subsequent chapters. For at present, we tin can simply annotation that a competitive market is one with many buyers and sellers in each market and in which entry and get out are adequately like shooting fish in a barrel. No one controls the cost; the forces of demand and supply determine price.

The second condition that must hold if the market is to achieve an efficient allocation concerns property rights. We plow to that topic in the next section.

The Part of Property Rights

A smoothly functioning market requires that producers possess property rights to the goods and services they produce and that consumers possess belongings rights to the appurtenances and services they purchase. Holding rightsA ready of rules that specify the means in which an owner can use a resource. are a ready of rules that specify the ways in which an possessor can employ a resources.

Consider the tomato market. Farmers who grow tomatoes have clearly defined rights to their land and to the tomatoes they produce and sell. Distributors who buy tomatoes from farmers and sell them to grocers have clear rights to the tomatoes until they sell them to grocers. The grocers who purchase the tomatoes retain rights to them until they sell them to consumers. When yous purchase a love apple, you have the sectional right to its use.

A system of belongings rights forms the basis for all market substitution. Before substitution can begin, there must exist a clear specification of who owns what. The organisation of property rights must too show what purchasers are acquiring when they buy rights to particular resource. Because property rights must exist if substitution is to occur, and because substitution is the process through which economical efficiency is accomplished, a system of property rights is essential to the efficient allocation of resources.

Imagine what would happen in the market for tomatoes if holding rights were non conspicuously defined. Suppose, for example, that grocers could not legally prevent someone from simply grabbing some tomatoes and leaving without paying for them. If that were the case, grocers would non exist probable to offer tomatoes for sale. If information technology were the case for all grocery items, there would not exist grocery stores at all.

Although holding rights vary for unlike resource, two characteristics are required if the marketplace is to achieve an efficient allocation of resources:

- Property rights must be sectional. An exclusive property correctA property right that allows its possessor to prevent others from using the resource. is one that allows its owner to forestall others from using the resource. The owner of a house, for example, has the right to exclude others from the apply of the house. If this right did not exist, ownership would take little value; it is not likely that the property could be exchanged in a market. And the inability to sell property would limit the incentive of owners to maintain information technology.

- Property rights must be transferable. A transferable property correctA property right that allows the owner of a resource to sell or lease it to someone else. is one that allows the possessor of a resources to sell or lease it to someone else. In the absenteeism of transferability, no substitution could occur.

Markets and the Efficiency Condition

A competitive market with well-divers and transferable property rights satisfies the efficiency conditionA situation that requires a competitive marketplace with well-defined and transferable property rights. . If met, we can assume that the market place's allocation of resources will be efficient.

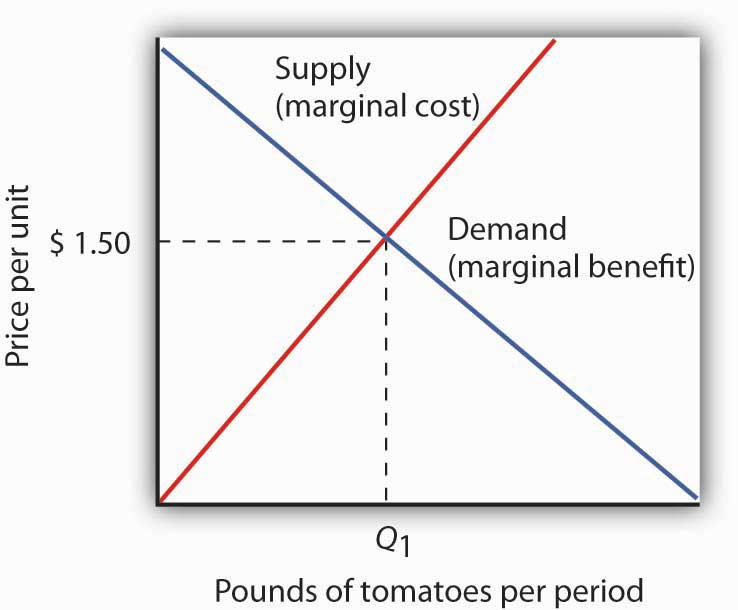

Consider again your purchase of tomatoes. Suppose the curves of demand and supply for tomatoes are those given in Figure 6.7 "Need and Supply and the Efficiency Condition"; the equilibrium toll equals $1.50 per pound. Suppose further that the market satisfies the efficiency status. With that assumption, we can relate the model of demand and supply to our assay of marginal benefits and costs.

Figure half dozen.7 Demand and Supply and the Efficiency Status

In a competitive market with sectional and transferable belongings rights, such as the market for tomatoes, the efficiency condition is met. Buyers and sellers are faced with all of the relevant benefits and costs, and the equilibrium price equals the marginal cost to society of producing that good, here $2.l per pound. Nosotros tin can interpret the market demand and supply curve as marginal benefit and marginal price curves, respectively.

The need bend tells us that the last pound of tomatoes was worth $1.50; we can think of that equally the marginal benefit of the terminal pound of tomatoes since that is how much consumers were willing to pay. We can say that about any price on a market demand bend; a demand bend tin exist considered as a marginal benefit curve. Similarly, the supply bend can be considered the marginal cost curve. In the case of the lycopersicon esculentum market, for example, the price tells us that the marginal cost of producing the final pound of tomatoes is $i.50. This marginal price is considered in the economic sense—other goods and services worth $1.50 were not produced in order to make an additional pound of tomatoes available.

On what basis can we presume that the cost of a pound of tomatoes equals its marginal price? The answer lies in our marginal conclusion rule. Profit-maximizing love apple producers will produce more than tomatoes as long as their marginal benefit exceeds their marginal cost. What is the marginal benefit to a producer of an extra pound of tomatoes? It is the toll that the producer volition receive. What is the marginal cost? Information technology is the value that must be given up to produce an actress pound of tomatoes.

Producers maximize profit by expanding their production up to the signal at which their marginal cost equals their marginal benefit, which is the market place cost. The price of $1.l thus reflects the marginal cost to social club of making an additional pound of tomatoes bachelor.

At the equilibrium price and output of tomatoes, then, the marginal benefit of tomatoes to consumers, as reflected past the price they are willing to pay, equals the marginal cost of producing tomatoes. Where marginal do good equals marginal price, internet benefit is maximized. The equilibrium quantity of tomatoes, as determined past demand and supply, is efficient.

Producer and Consumer Surplus

Think almost the final matter y'all purchased. You bought it because you expected that its benefits would exceed its opportunity cost; yous expected that the buy would brand you ameliorate off. The seller sold it to you considering he or she expected that the coin you paid would be worth more than the value of keeping the item. The seller expected to be meliorate off as a result of the auction. Exchanges in the marketplace have a remarkable holding: Both buyers and sellers wait to emerge from the transaction better off.

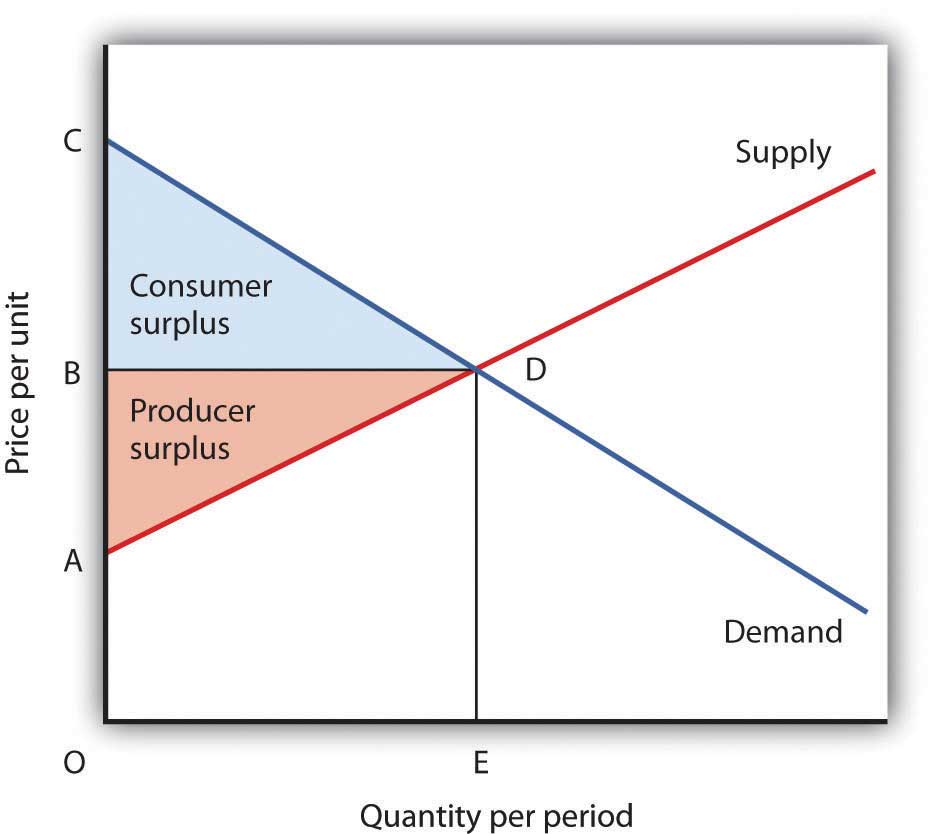

Panel (a) of Figure half dozen.viii "Consumer and Producer Surplus" shows a market demand bend for a particular good. Suppose the price equals OB and the quantity equals OE. The area under the demand curve over the range of quantities from the origin at O to the quantity at E equals the total benefit of consuming OE units of the skilful. It is the area OCDE. Consumers pay for this benefit; their total expenditures equal the rectangle OBDE, which is the night shaded region in the graph. Because the full benefits exceed total expenditures, there is a consumer surplus given past the triangle BCD. Consumer surplusThe amount past which the total benefits to consumers from consuming a skillful exceed their total expenditures on the good. is the amount by which the full benefits to consumers from consuming a good exceed their total expenditures on the good.

Effigy 6.eight Consumer and Producer Surplus

Consumer surplus [Panel (a)] measures the difference between total benefit of consuming a given quantity of output and the total expenditures consumers pay to obtain that quantity. Here, total benefits are given by the shaded area OCDE; total expenditures are given past the rectangle OBDE. The difference, shown by the triangle BCD, is consumer surplus.

Producer surplus [Panel (b)] measures the departure between full revenue received past firms at a given quantity of output and the full cost of producing it. Here, total acquirement is given by the rectangle OBDE, and total costs are given by the surface area OADE. The difference, shown past the triangle ABD is producer surplus.

At present consider the sellers' side of transactions. Console (b) of Figure 6.8 "Consumer and Producer Surplus" shows a market supply bend; recall that it gives usa marginal price. Suppose the market place toll equals OB and quantity supplied is OE; those are the same values we had in Panel (a). The price times the quantity equals the total acquirement received by sellers. It is shown as the shaded rectangle OBDE. The total revenue received by sellers equals total expenditures by consumers.

The total cost to sellers is the area under the marginal toll curve; information technology is the area OADE. That cost is less than revenue. The difference betwixt the total revenue received past sellers and their full price is called producer surplusThe divergence betwixt the total acquirement received past sellers and their full cost. . In Panel (b) it is the calorie-free-shaded triangle ABD.

Effigy vi.nine Net Benefit: The Sum of Consumer and Producer Surplus

The sum of consumer surplus and producer surplus measures the net benefit to society of any level of economic activity. Net benefit is maximized when production and consumption are carried out at the level where the demand and supply curves intersect. Hither, the net benefit to society equals the surface area ACD. It is the sum of consumer surplus, BCD, and producer surplus, ABD.

We put the demand and supply curves of Effigy 6.viii "Consumer and Producer Surplus" Panels (a) and (b) together in Figure 6.9 "Net Benefit: The Sum of Consumer and Producer Surplus". The intersection of the two curves determines the equilibrium price, OB, and the equilibrium quantity, OE. The shaded regions give usa consumer and producer surplus. The sum of these two surpluses is net do good. This net do good is maximized where the need and supply curves intersect.

Efficiency and Equity

Consumer demands are affected by incomes. Demand, after all, reflects power every bit well as willingness to pay for goods and services. The market will be more responsive to the preferences of people with high incomes than to those of people with low incomes.

In a market that satisfies the efficiency condition, an efficient allocation of resource will emerge from any particular distribution of income. Different income distributions will result in different, but nonetheless efficient, outcomes. For example, if 1% of the population controls almost all the income, so the market will efficiently allocate virtually all its product to those aforementioned people.

What is a off-white, or equitable, distribution of income? What is an unfair distribution? Should anybody have the same income? Is the current distribution fair? Should the rich have less and the poor have more? Should the middle class have more? Equity is very much in the mind of the observer. What may seem equitable to one person may seem inequitable to another. In that location is, still, no examination we can apply to determine whether the distribution of income is or is non equitable. That question requires a normative judgment.

Determining whether the allocation of resources is or is non efficient is one trouble. Determining whether the distribution of income is off-white is another. The governments of all nations human action in some way to redistribute income. That fact suggests that people generally have concluded that leaving the distribution of income solely to the market place would not be fair and that some redistribution is desirable. This may take the form of higher taxes for people with higher incomes than for those with lower incomes. Information technology may take the form of special programs, such as welfare programs, for low-income people.

Any distribution order chooses, an efficient allotment of resources is even so preferred to an inefficient ane. Because an efficient resource allotment maximizes internet benefits, the gain in net benefits could be distributed in a style that leaves all people improve off than they would be at any inefficient allocation. If an efficient allocation of resources seems unfair, it must exist because the distribution of income is unfair.

Key Takeaways

- In a competitive organisation in which the interaction of need and supply decide prices, the corresponding demand and supply curves tin be considered marginal benefit and marginal price curves, respectively.

- An efficient allocation of resources is one that maximizes the net benefit of each activity. We expect it to be achieved in markets that satisfy the efficiency status, which requires a competitive market and well-defined, transferable belongings rights.

- Consumer surplus is the amount by which the total benefit to consumers from some action exceeds their total expenditures for it.

- Producer surplus is the corporeality by which the total revenues of producers exceed their total costs.

- An inequitable allocation of resource implies that the distribution of income and wealth is inequitable. Judgments about equity are normative judgments.

Endeavor It!

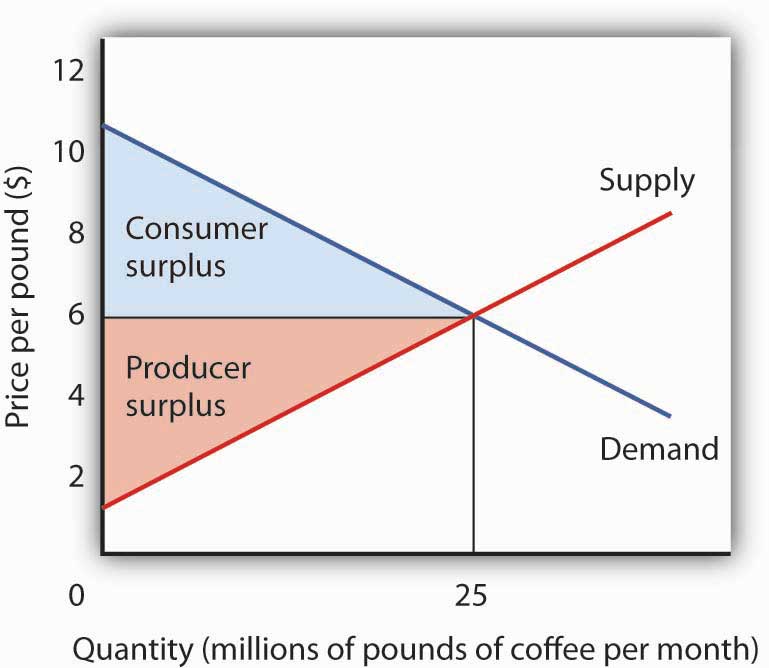

Draw hypothetical demand and supply curves for a typical production, say java. Now prove the areas of consumer and producer surplus. Nether what circumstances is the marketplace probable to exist efficient?

Case in Point: Bah Humbug!

Professor Joel Waldfogel, in his volume Scroogenomics, derides Christmas gift giving as only an economist would. Based on repeated surveys from students in his classes (which asked them to compare value and cost of gifts they received and of items they bought for themselves) and estimates of annual Christmas spending in the U.s. of $66 billion in 2007, he concludes that $12 billion, roughly xviii% of the full, constituted deadweight loss. And that doesn't count the 2.8 billion hours collectively spent shopping for the stuff.

The crux of his argument is that when y'all buy something for yourself, the price you pay is at least equal to the value of the satisfaction you get from the particular. For some items, the consumer surplus (the difference between the value to you of the item and the toll you pay), may be pocket-sized or fifty-fifty nada, but for other items it may exist large. One case he gives where consumer surplus may be huge is the purchase of a $xx antibiotic for your kid with an ear infection who has been screaming all dark. Just what are the chances that consumer surplus will exist positive for an item you lot receive as a gift? "Relative to how much satisfaction their [gift givers] expenditures could have given us, their choices destroy value. Have that, Santa," writes Professor Waldfogel.

Doesn't sentimental value make upward for the differences between the price of an item you receive, say a $fifty sweater, and the value you adhere to it, say $25? If y'all attach $l in sentimental value to the sweater, then information technology is really worth $75 to you, which is more than the $50 cost paid by the gift giver. The problem with this line of argument is that if the gift giver had chosen a sweater for yous that yous actually liked—1 that you valued at least at the buy price of $fifty—its total value to y'all would so have been $100. Compared to giving y'all a sweater you actually liked, giving you the one you did not much care for destroyed value.

The surveys accept too questioned the relationship of the gift giver to the gift recipient to see if giver knowledge of the recipient leads to more gift giving efficiency. The results are equally ane might look. Gifts from aunts, uncles, and grandparents generated between 75 and 80 cents of satisfaction per dollar spent. Friends generated 91 cents, parents 97 cents, siblings 99 cents, and significant others 102 cents of satisfaction per dollar spent. In full general, frequency of contact between giver and receiver increases the yield of a souvenir.

While acknowledging that in that location are some situations in which gifts may create value for recipients beyond what they could have purchased for themselves, such every bit when a recipient receives a CD of a band he or she was unfamiliar with but turns out to love, overall Waldfogel's estimates reveal a great loss for society. What to do about it? Giving greenbacks would piece of work but there seems to exist a stigma associated with doing so, especially for sure kinds of relationships between givers and receivers. Gift registries solve the trouble for newlyweds and could do and so for Christmas gifts if that idea defenseless on. Since outside of your firsthand circle you are unlikely to select a souvenir that does not destroy value, he suggests giving cash, if that is non also uncomfortable, or gift cards, perchance ones for charitable causes. Of course, people often forget to employ their souvenir cards. When that happens, the benefit is not lost but rather goes to the retailer, which was not likely the intention of the souvenir giver. He thus suggests that retailers team up with charities so that whatsoever corporeality non redeemed after a certain time period goes to a charity stated on the gift carte.

Parodying Karl Marx's Communist Manifesto, he concludes, "A specter has been haunting the rich economies of the West, and that specter is wasteful gift giving. Gift givers of the world unite. You have nothing to lose but deadweight loss and a world of satisfaction to gain."

Source: Joel Waldfogel, Scroogenomics: Why Y'all Shouldn't Buy Presents for the Holidays (Princeton: Princeton University Press, 2009).

Answer to Try Information technology! Problem

On the assumption that the coffee marketplace is competitive and that information technology is characterized by well-defined exclusive and transferable property rights, the coffee market meets the efficiency condition. That means that the allotment of resources shown at the equilibrium will exist the one that maximizes the net benefit of all activities. The net benefit is shared past coffee consumers (as measured by consumer surplus) and coffee producers (equally measured by producer surplus).

bloodworthbeids1961.blogspot.com

Source: https://saylordotorg.github.io/text_principles-of-economics-v2.0/s09-02-maximizing-in-the-marketplace.html

0 Response to "what is the marginal benefit to a producer of an extra pound of apples in panel (a)?"

Enregistrer un commentaire